Thought Leadership

How Does Peppol eInvoicing Work?

October 11, 2021

This post was originally written and published for Information and Data Manager

E-invoicing is not a new concept. Electronic invoices have been around for a while, in several different formats, standards, and names. All claiming to connect buyers and suppliers digitally and more efficiently.

The issue was that many e-invoicing systems were expensive and time consuming to set up. This meant that it was only something large businesses, who typically had a big volume of orders or invoices to process, considered implementing. The lack of a consistent and single format and framework for e-invoicing also kept it from being widely adopted by many smaller businesses.

The turning point for e-invoicing has been the adoption of a globally recognised standard for sending e-invoices and e-orders, known as Peppol (Pan-European Public Procurement Online). The Peppol standard enables anyone who is part of its global network to send e-invoices and e-orders easily and safely to each other.

The standard also enables a simple and accessible way for businesses to be onboarded onto the network, which has driven adoption across the world.

There are already 200,000+ businesses across 34 (and counting) markets on the Peppol network. Recently Australia, New Zealand, and Singapore have all adopted the standard as the basis for their latest national and regional e-invoice mandates.

how does peppol e-invoicing work?

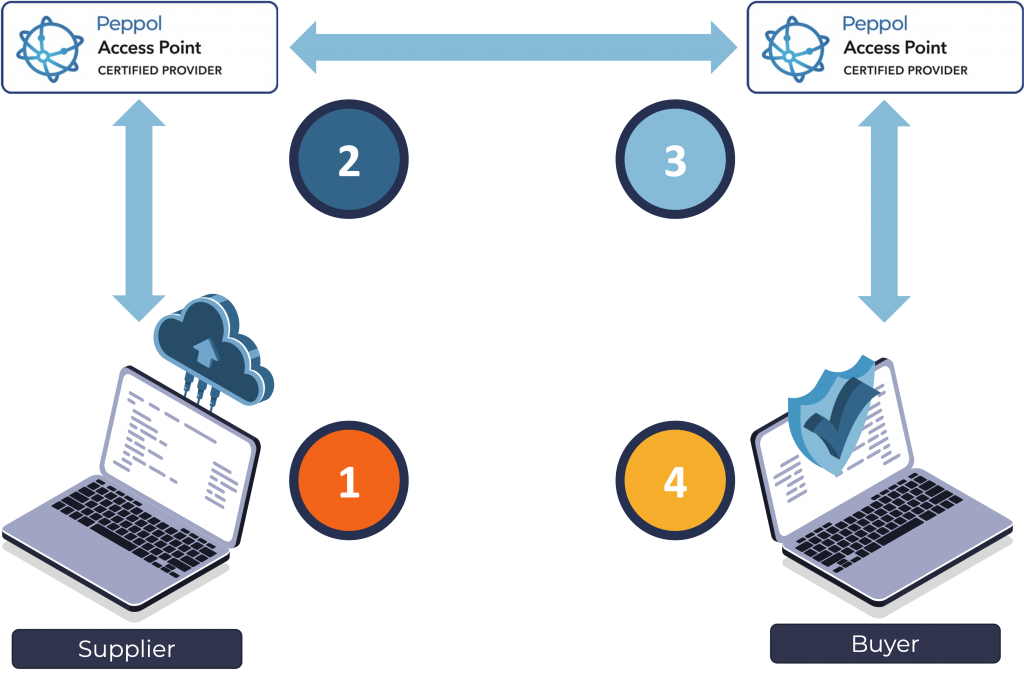

The below diagram shows how Peppol e-invoices are sent and received:

- Step 1. The supplier generates an invoice in their accounts receivable system and sends it electronically to their Certified Peppol Access Point.

- Step 2. The sender’s Peppol Access Point validates the invoice to make sure that it can be sent via the Peppol network. They check if the supplier is legitimate and that the receiver can receive the invoice. The sender’s Access Point finds the buyer’s Access Point and sends it over electronically.

- Step 3. The buyer’s Access Point receives the validated invoice and processes it directly into the buyer’s accounts payable system. This is typically done via an integration between the buyer’s system and the Access Point provider.

- Step 4. The supplier’s invoice is automatically entered into the buyer’s system. There is no need for either party to do any manual data entry or checks. The whole process takes a matter of minutes. It is highly secure and very easy to use.

how much does peppol e-invoicing cost and what should you look for in an access point?

As adoption of Peppol e-invoicing continues to grow in Australia and APAC, more and more businesses are starting to investigate how they can get started. One of the first questions that comes up in many of the conversations I’m having is how much Peppol e-invoicing costs?

There is not a simple answer, but the ATO recently approximated the cost of processing an invoice in three ways, comparing the cost of processing a paper, PDF and e-invoice. The differences are clear:

- Paper invoices – approximately $A30 per invoice

- PDF Invoices – approximately $A27 per invoice

- E-invoice – less than $A10 per invoice

Multiplying these figures by the number of invoices you send and receive on a daily, weekly, or monthly basis (i.e. your invoice volume over a given period) gives you an idea of the total cost for each type of system and the savings you could be making by adopting Peppol e-invoicing.

However, as there are several different Certified Peppol Access Point providers across Australia and New Zealand, the costs involved with each provider varies. But there are usually two main costs to consider, and businesses should make sure their providers’ pricing structure reflects its ability to scale, as the number of transactions, e-invoices, or e-orders they send or receive grows over time:

- An implementation fee – this covers the initial setup of your Access point and integration into your finance systems. That could cover an integration from your accounts payable platform into your access point, an integration from your accounts receivable platform into your access point, or both.

- Monthly subscription fee – Once your finance systems are connected to your access point there is usually a monthly Peppol subscription fee. This covers the costs involved in sending and receiving business documents (e.g., e-invoices, e-orders) via the Peppol Network.

Remember to make sure that any subscription or monthly fee is volume-based, so that you are only paying for what you use. With greater discounts available for greater volumes, the average cost per business document sent or received should go down as your volumes increase.