Thought Leadership

The Evolution of Invoicing: From Paper To Open Networks – Are You Being Left Behind?

July 07, 2021

Australia and New Zealand are continuing their push towards adopting new e-invoicing standards through recently announced mandates to utilise Peppol e-invoicing in the region, following on from similar initiatives across the globe. One of the themes we have noticed from our discussions with businesses across the region, is the notion that they are already “doing e-invoicing” as they send and receive PDF invoices via email, why then does Peppol e-invoicing keep coming up?

We take a deep dive into the evolution of invoicing from unstructured data (i.e. low-quality raw data that cannot be processed directly by the finance/accounting systems) via Paper and PDF to structured data (i.e. high quality data following some standard syntax like xml, json that can be processed directly by the finance/accounting systems) via EDI, closed and open networks, why Peppol e-invoicing is the future and how to make sure your business doesn’t get left behind.

Peppol e-invoicing is changing the game across the globe in standardising and democratising e-invoicing for businesses of any size. To understand how invoicing has evolved through the years, it’s helpful to think of each iteration of invoicing transmission as its own ‘generation’, like wireless mobile telecommunications technology – 1G, 2G, 3G, 4G and 5G.

generations of invoicing

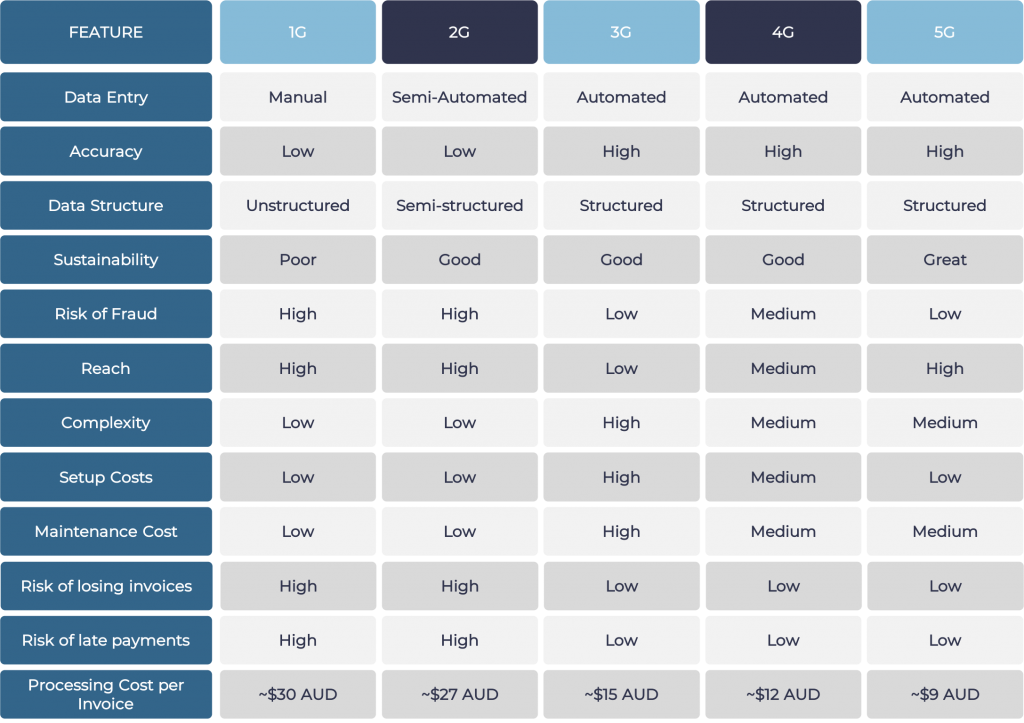

comparison between invoice generations:

1g paper invoicing:

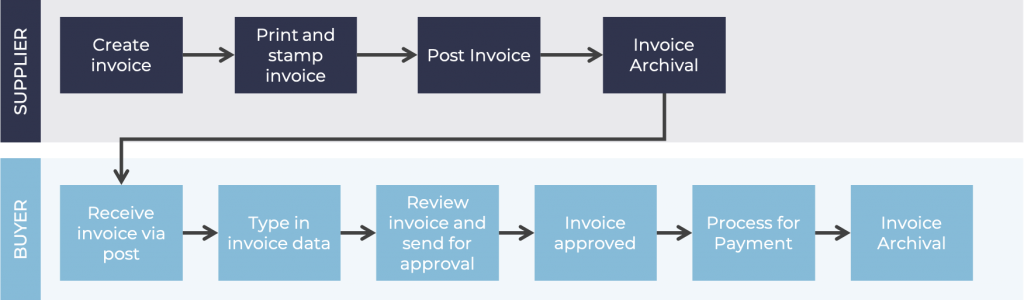

The first generation (1G) of modern invoicing where businesses have been sending paper invoices via post to their buyers.

The typical process flow for 1G invoicing started out like this:

As technology evolved, particularly, data capture technology, the process evolved to include a scanning solution, the invoice process did not fundamentally change though.

1G Invoicing – In Detail

Data Entry

Manual – Invoices are created manually in the suppliers system and then manually entered into the buyers system. The data is either read off the invoice document or the scanned image of the invoice.

Data Structure

Unstructured – The data is on paper in raw form and therefore has no structure.

Sustainability

Poor – printing and postage of invoices consumes amount of natural resources.

Risk of Fraud

High – Easy to manipulate paper invoices or send in a fraudulent invoice – requires manual validation.

Reach

High – Can be sent to anyone with a postal address.

Complexity

Low – straightforward but inefficient process to run.

Setup Costs

Low – very little infrastructure required to send or receive invoices.

Data Accuracy

Low – manually entered data and therefore prone to error.

Maintenance cost

Low – minimal infrastructure to maintain to send or receive invoices.

Risk of losing invoices

High – paper invoices can be lost in the post or misplaced when they reach the buyer.

Risk of late payment

High – Due to manual processes involved, the processing times for 1G invoices can be longer increasing the risk of late payments

Processing Cost Per Invoice

~$30 AUD

There are still many businesses in Australia, New Zealand and globally that predominantly send paper invoices. It is high time for such businesses to switch to 5G invoicing

2g emailed pdf invoice:

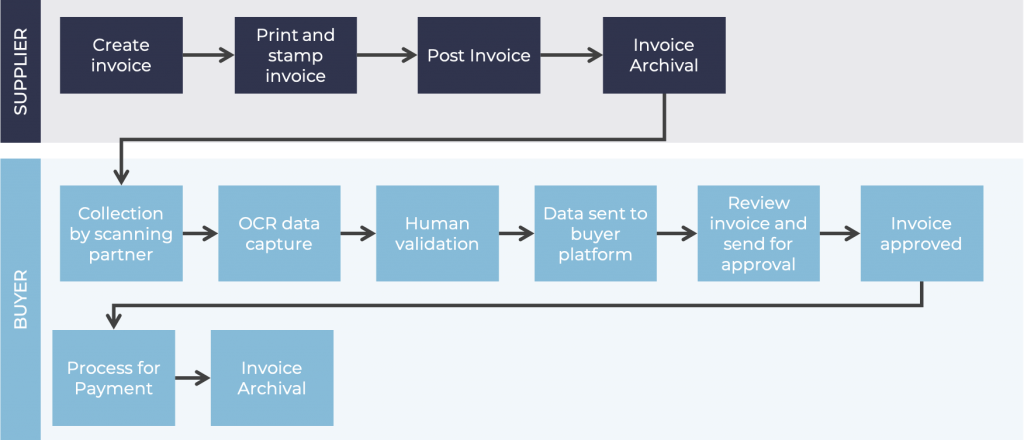

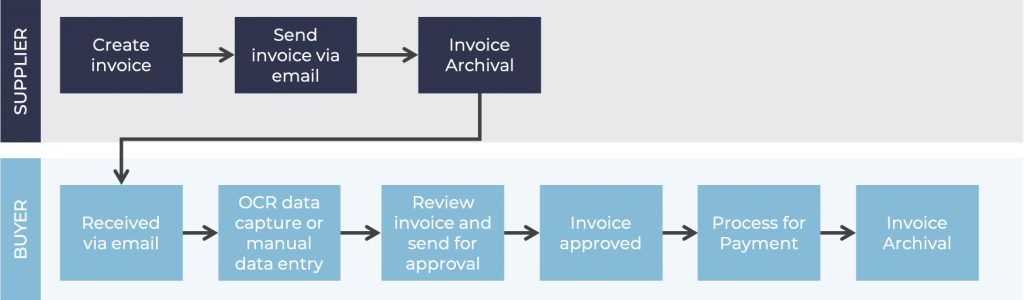

The second generation (2G) of modern invoicing is where businesses send their invoice to their customer via email as a PDF. A typical second generation invoice process flow is outlined below.

2G Invoicing – In Detail

Data Entry

Semi-automated – some providers utilise OCR to capture data from PDF invoices.

Data Structure

Semi-structured – as some of the data is captured off the invoice there is some structure to the data but accuracy is a challengee.

Sustainability

Good – emailing invoice is far more sustainable than paper and post invoicing.

Risk of Fraud

High – Invoices can easily be intercepted and manipulated before being received by the organisation.

Reach

High – Can be sent to anyone with an email address.

Complexity

Low – straightforward but inefficient process to run.

Setup Costs

Low – very little infrastructure required to send or receive invoices.

Data Accuracy

Low – manually entered data is prone to error and OCR accuracy is usually below 80%

Maintenance cost

Low – minimal infrastructure to maintain to send or receive invoices.

Risk of losing invoices

High – paper invoices can be lost in the post or misplaced when they reach the buyer.

Risk of late payment

High – Due to manual processes involved, the processing times for 2G invoices can be longer increasing the risk of late payments.

Processing Cost Per Invoice

~$27 AUD

It was first major step towards digitalisation of invoicing and is the currently most common form of invoicing in Australia, New Zealand and globally.

3g point-to-point edi:

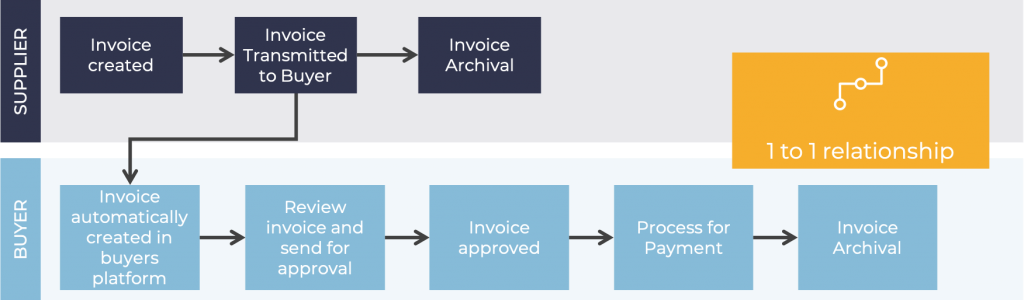

The third generation (3G) of invoicing which, is also referred to as e-invoicing, is where businesses develop system to system integrations with suitably sized buyers and customers to send and receive invoice and order data directly. This is also referred as 2 corner model where the supplier and buyer are integrated on a one to one relationship.

A typical third generation invoice process flow is outlined below:

3G Invoicing – In Detail

Data Entry

Automated – data is integrated directly from the suppliers systems to the buyers.

Data Structure

Structured – a variety of formats are in use e.g. XML, EDI.

Sustainability

Good – direct transfer of invoice data is far more sustainable than paper and post invoicing.

Risk of Fraud

Low – point to point integrations minimise the risk of fraudulent invoices being processed.

Reach

Limited – only available to those suppliers that you have created an integration with.

Complexity

High – Differing formats and systems create a high level of complexity in the process.

Setup Costs

High – requires IT and integration expertise and is custom built for each supplier/buyer relationship.

Data Accuracy

High – direct exchange of structured data from system to system.

Maintenance cost

High – custom built point of point integrations are required to be maintained.

Risk of losing invoices

Low – data is transferred directly into the buyers system so the risk is very low

Risk of late payment

Low – Due to the automated processes involved, processing times for 3G invoices are faster, reducing the risk of late payments.

Processing Cost Per Invoice

~$15 AUD

Large businesses developed system to system connections in Australia, New Zealand and globally however it has not been an affordable option for small and medium sized businesses. Meanwhile, large businesses have struggled to scale past a small selection of suppliers.

4g closed networks:

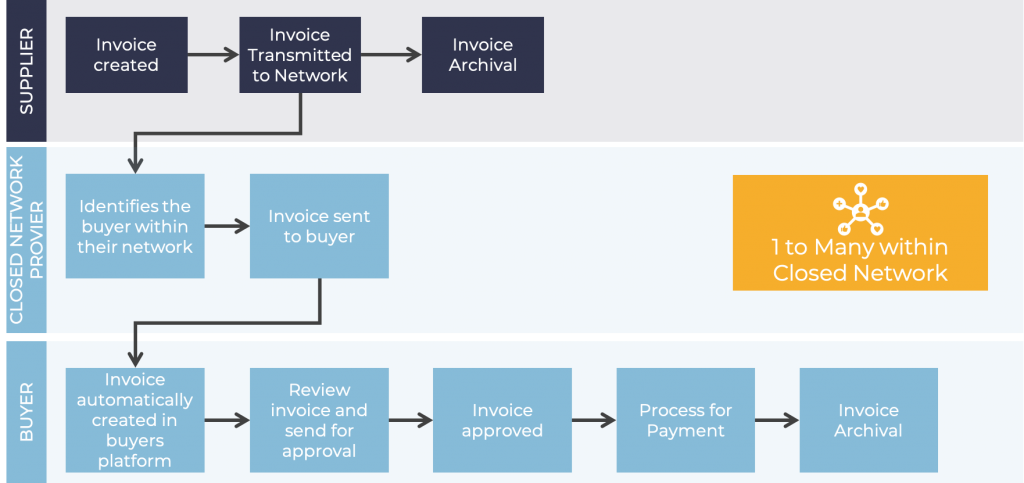

The fourth generation (4G) of invoicing is where system integrators involved in the implementation of point-to-point EDI integrations for large businesses started building their own closed networks to scale up EDI integrations in a way that suppliers and buyers can integrate easier using the same service provider as opposed to requiring a new 1-1 integration each time.

This eased the onboarding challenge for large businesses, however it still hasn’t been able to address the real problem of scalability and affordability to all businesses.

4G Invoicing – In Detail

Data Entry

Automated – data is integrated directly from the suppliers systems to the buyers

Data Structure

Structured – a variety of formats are in use e.g. XML, EDI

Sustainability

Good – direct transfer of invoice data is far more sustainable than paper and post invoicing.

Risk of Fraud

Low – point to point integrations minimise the risk of fraudulent invoices being processed.

Reach

Limited – only available to those suppliers that are in the network and have agreed to integrate with you.

Complexity

Medium – Closed network attempted to simplify the system to system complexity.

Setup Costs

Medium – The initial setup costs can be scaled across all the suppliers that you are connected to in the network.

Data Accuracy

High – direct exchange of structured data from system to system.

Maintenance cost

Medium – custom built point of point integrations are required to be maintained.

Risk of losing invoices

Low – data is transferred directly into the buyers system so the risk is very low

Risk of late payment

Low – Due to the automated processes involved, processing times for 4G invoices are faster, reducing the risk of late payments.s

Processing Cost Per Invoice

~$12 AUD

5g open networks:

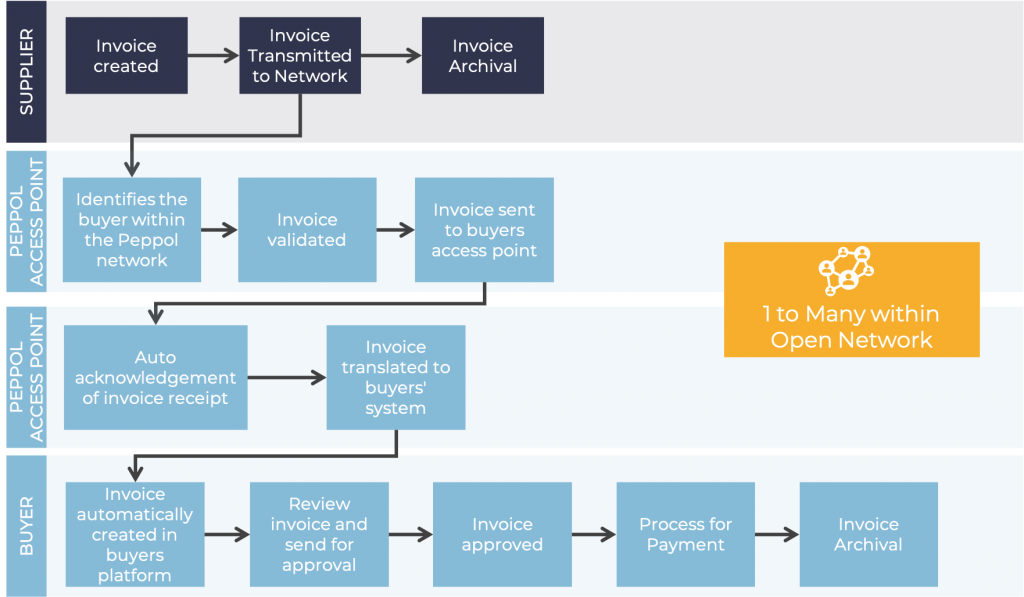

The fifth generation (5G) of invoicing is where existing procurement systems are enabled for e-invoicing via Open networks like Peppol. An open network with regulated and standardised formats addresses the issues of fragmented standards, security, reliability, scalability, affordability, adoption and innovation.

Peppol governing authorities run by Government Agencies in Singapore, AustrlaIia and New Zealand manage governance and adoption, whilst certified Peppol service providers like Valtatech provide access to the Peppol network through their access point services. Whilst also enabling platforms like Coupa, TechnologyOne, MYOB to become Peppol enabled for their customers.

Peppol e-invoicing is the most common way of e-invoicing today across the globe with exchange of nearly 200 million e-invoices annually and keep evolving at a rapid pace. Read more about Peppol.

5G Invoicing – In Detail

Data Entry

Automated – data is integrated directly from the suppliers systems to the buyers

Data Structure

Structured – standard BIS 3.0 format

Sustainability

Good – direct transfer of invoice data is far more sustainable than paper and post invoicing.

Risk of Fraud

Low – Peppol security standards ensure the buyer and sender are legitimate.

Reach

High – Buyers and suppliers can trade openly with anyone in the network

Complexity

Medium – Peppol network is completely standardised making it easy to work with once setup.

Setup Costs

Low – The initial setup costs can be scaled across all the suppliers within the Peppol network.

Data Accuracy

High – direct exchange of structured data from system to system.

Maintenance cost

Low – universal standards ensure maintenance is straightforward. You connect once, you connect to all suppliers in the network.

Risk of losing invoices

Low – data is transferred directly into the buyers system so the risk is very low

Risk of late payment

Low – Due to the automated processes involved, processing times for 5G invoices are faster, reducing the risk of late payments.

Processing Cost Per Invoice

~$9 AUD

what is peppol e-invoicing?

Peppol e-invoicing is a standardised way to exchange the structured invoice data between finance systems of the trading businesses eliminating manual handling through a secure and scalable Network. It is the future of e-invoicing that has been adopted by most European countries, Singapore, Australia and New Zealand as the country wide e-invoicing standard. Malaysia, Japan and Philippines are on the path to adapt Peppol e-invoicing and it is evolving at a rapid scale with interest from OECD and WTO countries.

Several mandates are upcoming for Australian federal and state government agencies and businesses to switch to Peppol e-invoicing. Don’t be left behind and make your move now to be prepared for the future of e-invoicing.