Thought Leadership

Why Use Peppol eInvoicing?

September 29, 2021

This post has been adapted from an article we originally wrote and published in Information and Data Manager

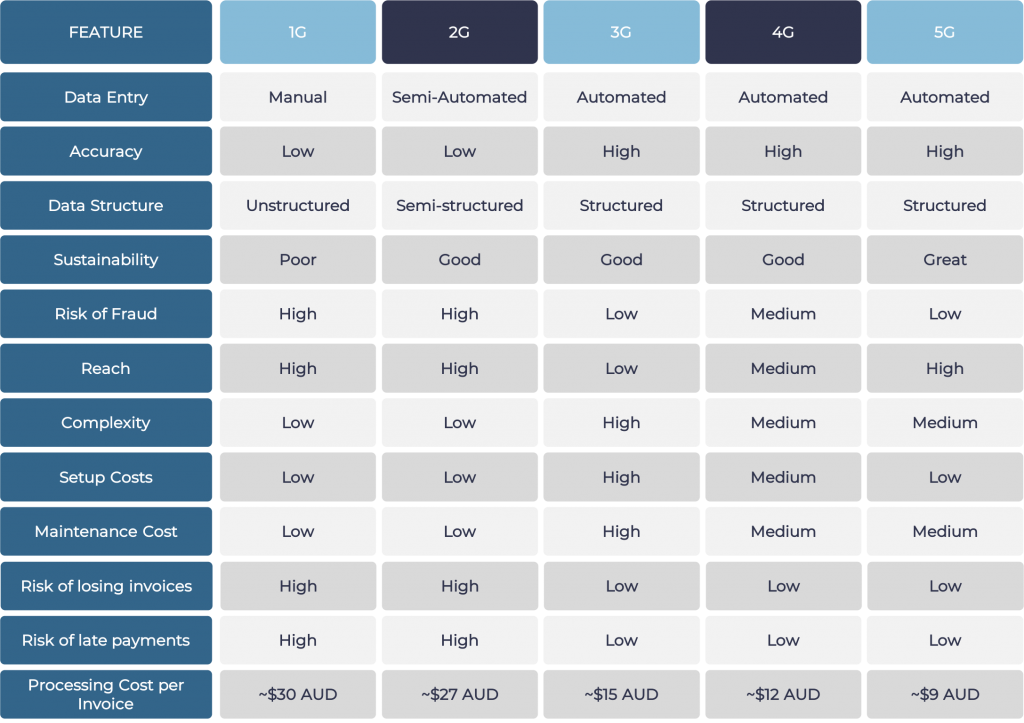

The Australian government believes that e-invoicing can save the economy $28bn over 10 years. Sounds great, but what are the actual benefits and why would businesses want to be able to send and receive Peppol e-invoices? The first thing to consider about Peppol e-invoicing is how you are currently processing invoices. Our resident e-invoicing experts pulled together a detailed overview of how invoicing has evolved and assessed each evolution of that option across a number of key factors:

Depending on which invoicing method you are currently using, the benefits of shifting to Peppol e-invoicing can be huge. Typically we find that Peppol e-invoicing (and e-ordering) can help support businesses with a range of challenges they face today:

problem: large supplier base making invoice automation impossible and too expensive

Utilising Peppol e-invoicing, once you are connected to the Peppol network through an Access Point, you are automatically connected with every other buyer and supplier in the network – greatly enhancing your ability to automate invoice processing with all your suppliers. If your trading partner is not on the Peppol network yet, we can help onboard them which doesn’t require any investment from you or your trading partners.

problem: high risk of invoice fraud

PDF invoices can easily be intercepted mid-flight and manipulated before being received by the buyer and email compromise scams like this are on the rise, a topic we wrote about recently. With Peppol e-invoicing, the sender is validated to ensure they are who they say they are and that bank account details match your records before transmitting the data through the Peppol network.

The network itself is highly secure as only accredited Peppol Access Points providers like Valtatech can exchange the documents over the Peppol network. Access providers like us are required to meet strict security protocols equivalent to ISO27001 covering intrusion prevention, multi-factor authentication for privileged user access and data encryption to ensure the security of the network.

problem: cash flow management during the pandemic

Businesses can be crippled when buyers pay them late, invoices can get missed when it’s reliant on human intervention. Equally, buyers can miss out on early payment discounts if the invoice is lost or not processed quickly. E-invoicing speeds the whole invoice processing piece up for both sides, removing the worry of whether an invoice has been received and processed or not. In Australia, Commonwealth and NSW government agencies guarantee 5-day payment terms for e-invoices which makes e-invoicing even more attractive.

problem: meeting esg commitments

Peppol e-invoicing is far more friendly to the environment compared to paper and PDF invoices helping to support your sustainability goals as an organisation.

how can we get started with peppol e-invoicing?

Enabling Peppol e-invoicing for your organisation should be simple, value driven and cost effective. We offer a range of different solutions to get your business ready for Peppol e-invoicing