Compliance as-a-Service (CaaS) and National e-Invoicing Initiative (NEI) Partner for Malaysia e-Invoicing Mandates

By partnering with Valtatech, taxpayers can ensure seamless compliance with the requirements set forth by the Inland Revenue Board (IRB) of Malaysia (LHDN) and the national e-invoicing initiative spearheaded by the Malaysia Digital Economy Corporation (MDEC). This strategic collaboration not only simplifies and streamlines the e-Invoice processes, leading to enhanced business efficiencies, but also guarantees utmost accuracy and significantly reduces the risks of manual errors.

Embracing e-Invoicing doesn’t just offer a smooth and hassle-free experience for taxpayers; it also plays a pivotal role in elevating operational efficiency and reinforcing strict adherence to tax regulations. Partnering with Valtatech ensures a seamless transition into the digital realm of e-Invoicing, paving the way for a more efficient and compliant future in the Malaysian business landscape.

Benefits of Valtatech CaaS (LHDN) + National e-Invoicing Initiative (NEI aka Peppol by MDEC) service

- Comply with both LHDN and MDEC National e-invoicing initiative

- Works with any system if you can send us the required content field in any structured format

- Both options available to either connect with our service or we can connect to your systems

- Fully integrated solution

- Live tracking of invoices via VT portal

- VT Reporting for invoices processed

- Added benefit of integrating directly to Customer ERP for Invoice delivery

- Added benefit of touchless electronic process

- Faster invoice processing time and guaranteed delivery

- Future proof

What is eInvoicing?

How does it drive AP Automation?

Sending a PDF invoice is, unfortunately, not an e-Invoice. The format of e-Invoice is not pdf, doc, jpg or even email – why? Well let’s compare the difference, when you send an PDF invoice, the invoice is delivered in a digital format (email as opposed to post) and when your customer receives it they still have to manually review the invoice, re-key the invoice information into their own system and then start to process it.

eInvoicing is the system-to-system exchange of invoice data, where invoices are sent directly from a supplier to a buyer – no manual data entry required at either end of the invoice.

Regardless of how your suppliers are sending their invoices, our range of eInvoicing services ensures that we can drive the highest level of automation possible.

An e-Invoice acts as a digital record of a transaction between a seller and a buyer, replacing the need for paper or electronic documents like invoices, credit notes, and debit notes. It includes essential information such as seller and buyer details, item descriptions, quantities, prices before tax, taxes, and total amounts, capturing transaction data for everyday business operations.

Why Do You Need eInvoicing

-

Onboard ALL of your suppliers

We provide an easy and accessible way to ensure that invoice data is captured in the most automated and efficient manner possible.

-

Free up your staff to focus on value adding activities

Remove the need for manual invoice data entry and exception handing to enable your team to focus on higher value activities. Via Valtatech CAAS and Peppol Access Point service which is using API, does not require businesses to access the MyInvois portal manually and login manually. This is ideal for big volumes e-invoices using Application Programming Interface (API) connection.

-

Remove the risk of invoice fraud COMPLETELY

Automated data validation checks and utilising the secure Peppol network, you never have to worry about invoice fraud again.

-

Facilitate Efficient Tax Filing

Smooth integration of systems to ensure precise tax reporting and compliance,

-

Digitalise Tax and Financial Reporting

Aligning financial processes with industry standards by digitalizing them

Our eInvoicing Platforms Have Processed

bn

m

k

Trusted By

AP Automation Solutions

Compliance as-a-Service (CaaS)

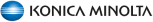

Our CaaS / InvoiceSense solutions helps businesses drive Touchless Invoice Processing by providing a cost effective, state of the art invoice data capture and validation that automates your suppliers invoice data entry regardless of how your suppliers are sending their invoices. A full-service model, we ensure that there is no manual invoice data entry or validation required from you. Helping you drastically reduce the risk of invoice fraud whilst driving automation and optimisation.

With Valtatech as service provider to comply with LHDN, taxpayers will not only get compliant with LHDN but also with Malaysian national e-invoicing initiative driven by MDEC to achieve business efficiencies by streamline their e-Invoice processes, ensuring accuracy and reducing the risk of manual errors.

CaaS

Data is validated by our Validation Engine running a series of data checks to ensure the validity of the invoice.

- Validates Supplier invoice

- Converts data into IRB format and submits with IRBM

- Receives IRBM Validation response (QR Code)

- Transfers Invoice with QR to Customer

- Cancels Invoices when required

Invoice Created in your ERP/Procure to Pay Platform

The validated invoice record is automatically created in your ERP or Procure to Pay Platform ready for processing.

Peppol eInvoicing Services - National E-Invoice Initiative (NEI) by MDEC

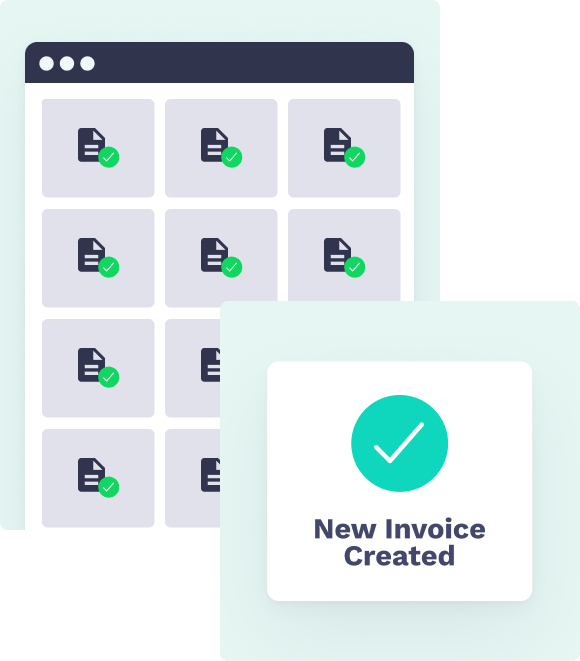

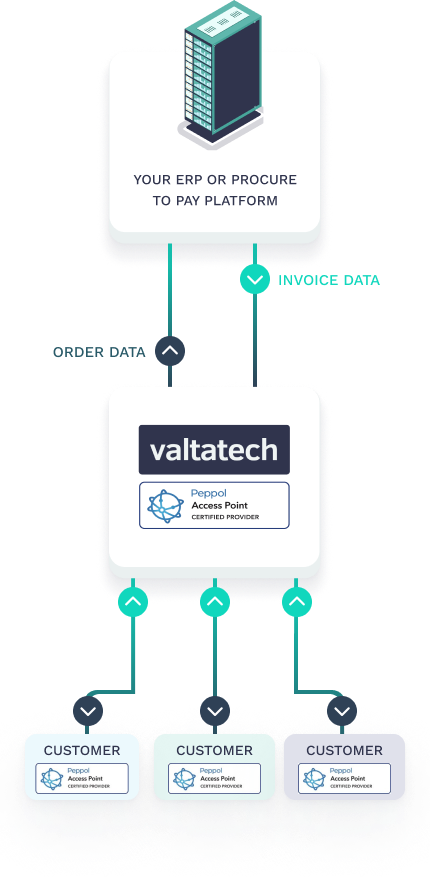

Peppol eInvoicing works by suppliers and buyers sending their invoices or orders directly to each other’s systems through a certified Peppol Access Point. The Access Point verifies the data on the invoice or order and then sends it on to the receiver’s certified Access Point who transmits the data into their system. This means that data is shared almost instantly into the receiver’s system without any manual data entry or manipulation required.

About Peppol eInvoicing

Over 1.2 billion Business to Business (B2B) and Business to Government (B2G) invoices are exchanged annually in Australia. The majority of these are sent either as paper invoices or PDF invoices via email. These are costly to process with manual data entry or validation usually required. The Australia Tax Office estimates that:

- Average invoice processing cost for a paper invoice is $30.87

- Average invoice processing cost for a PDF invoice is $27.67

Peppol eInvoicing is the automated digital exchange of invoice information directly between a buyer’s and supplier’s systems, removing the need for any manual data entry or validation. The ATO estimates that it can reduce the cost of processing an invoice down to $9.18.

“eInvoices are 66% cheaper to process than PDF invoices.” – Australian Taxation Office

Australia, New Zealand, Singapore, Japan and Malaysia have all adopted a globally recognised standard for sending eInvoices and eOrders known as Peppol (Pan-European Public Procurement OnLine). This standard enables anyone who is part of the network to easily and safely, send eInvoices and eOrders to each other. The standard also enables a simple and accessible way for businesses to be onboarded onto the network.

There are already 200,000+ businesses across 34+ countries on the Peppol network. Valtatech has been accredited as a Peppol certified eInvoicing service provider across Australia, New Zealand, Singapore and Japan as well as Malaysia soon. Accreditation can only be achieved by meeting strict standards set by the Peppol Authorities in terms of capabilities, security, compliance and performance, so you can be confident that your data is in safe hands working with us.

Accounts Receivable Automation

Our Peppol eInvoicing Services can be utilised for the full end to end order to cash process. From receiving purchase orders into your ERP through to sending your eInvoices to your customers, all data can be exchanged in a completely automated way through our Peppol Access point and then onto your suppliers Access Points.

Reduce the time spent chasing lost, missing or late payments

Peppol eInvoicing helps in two powerful ways:

- eInvoices are validated by the network before they are sent, you actually won’t be able to send an invoice to your customer if there is data missing from the invoice that needs to be there. You can have confidence that the invoice being sent to your customers has the information it needs on it.

- eInvoices sent via the Peppol network are sent digitally, point-to-point – that means 100% of your einvoices make it to your customer’s system so that they can process the invoice. This removes the risk that your eInvoice has ended up with the wrong person, has been misplaced, or forgotten about.

Eliminate the risk of your customers falling for invoice scams

Peppol eInvoicing, by design, is safe and secure – the traffic is encrypted end-to-end so there is no chance that data is going to be intercepted once the invoice is sent. Additionally, this adds confidence and reduces risk for your customers as all buyers and suppliers in the network are validated to ensure they are who they say they are. This almost completely mitigates the risk of your invoices being caught up in an invoice scam with your customers.

Add value to your customers

The benefits for your customers to receive your invoices via Peppol are huge. This will help them reduce their cost per invoice (through time savings), effectively mitigate the risk of invoice fraud as well as give them a scalable way to work with their other suppliers. You can use this as an opportunity to provide extra value for your customer base whilst also seeing direct benefits.